RAVENA — During an initial budget presentation on Tuesday, Feb. 6, Brian Bailey, superintendent of schools for Ravena-Coeymans-Selkirk Central School District, began by talking about anticipated revenue and the state tax cap — and how “mean” New York state is to public schools.

“The process is not fair,” he said. “It’s like asking you to design your house, having no idea how much money you’ll have to build it.”

Calling the timeline “unjust,” Bailey explained that the district is expected to have its budget planning done before the state has settled its budget negotiations, which directly affects how much money the school district will receive in state funding. “And, as we know, in New York state, they very frequently don’t meet their deadline,” he said.

While Bailey noted the $1.1 billion increase to education aid across the state that is included in Gov. Andrew Cuomo’s proposed 2019 executive budget, he says that the increase falls $300,000 short of the amount that would be needed to continue current programming and far short of the $4.2 billion behind fulfilling its foundation aid obligation.

The foundation aid formula was developed in response to a 2006 lawsuit in which the NYS Court of Appeals found that New York state was violating students’ constitutional right to a “sound and basic education” by leaving schools without adequate funding. The state was ordered to increase basic operating aid statewide by $5.5 billion over the course of a four-year phase-in from 2007 to 2011. In the wake of the 2008 national financial crisis caused by Wall Street, the state froze foundation aid funding in 2009. During the recession, $2.7 billion was cut from school aid, effectively reversing the state’s commitment to fully fund its classrooms.

According to Bailey, RCSCSD is currently receiving a larger allotment of disbursed foundation aid funding than it should under the formula, as the state is still calculating aid based on enrollment numbers from eight years ago, when the district had around 450 additional students. Should the state decide to equalize the formula, he said, “that would not work out well for us.”

Pressure felt from actions at the federal level, which have left programs like Medicaid and other sources of federal funding in a state of uncertainty, he explained, have also caused the state to put more pressure on local municipalities and school districts. “We have all these great mandates we’re expected to accomplish,” he said. “And they’re all unfunded obligations.”

In addition to that, Bailey continued, the state has enacted a 2 percent limit on “expenditure driven aid,” or funding for things such as transportation costs, many of which are state-mandated additional expenses. That means that if those costs exceed 2 percent of the total budget, the district will no longer receive reimbursement. “This is the enemy of public schools,” he said. “Public schools are under attack and we’re not the only game in town. Stay tuned.”

Joanne Moran, the district’s business manager, explained how the actual “2 percent” tax cap is calculated. The calculation, she said, is based on a tax base growth factor, a measure of municipal property developments and improvements, that is determined by the state and the Consumer Price Index (CPI), or the national rate of inflation.

According to Moran, 2018-19 will be the first year that the tax cap calculation allows the district to go over 2 percent. While it is currently calculated at 2.65 percent (a total of $655,249 the district is allowed to raise through taxes), that could increase to 2.75 percent, depending on a Payment In Lieu of Taxes from Coeymans Recycling. While the district can opt not to go to the full tax levy, Moran characterized that as a lost opportunity due to the fact that the district will not be able to recover lost funds in future years.

A more comprehensive explanation of the tax cap calculation can be viewed on the district’s website (www.rcscsd.org) by going to the Budget & Taxes tab under the Main Menu.

How RCS homeowners will be affected by the tax levy, said Moran, will depend on property assessment information that will not be available until this summer. If assessments go up, she said, the tax rate increase will be lower than if they go down.

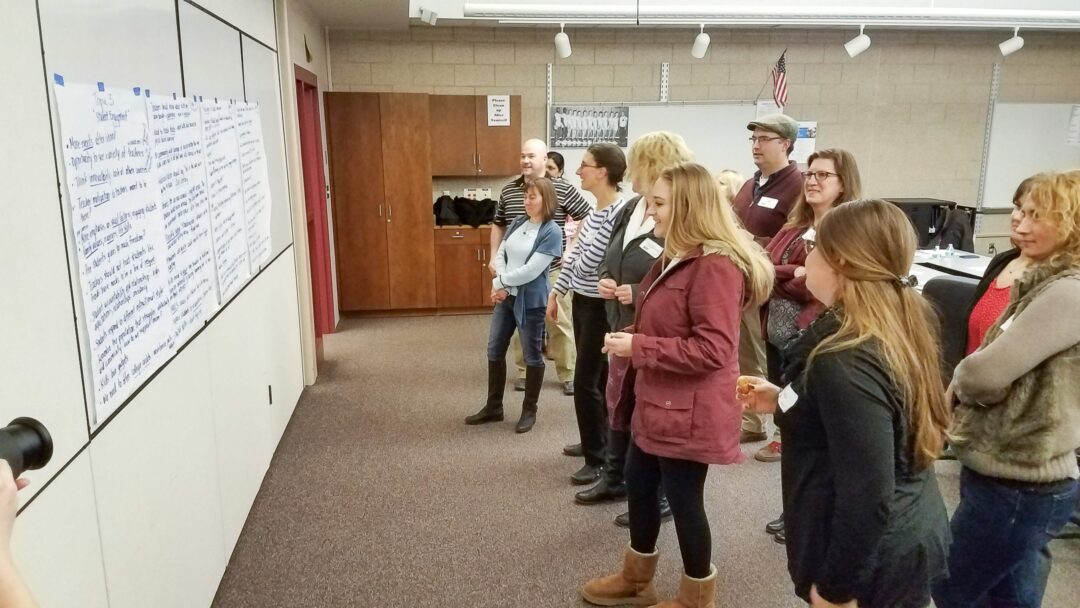

On the following Tuesday, Feb. 13, RCSCSD held a “future forum,” inviting all district stakeholders to a discussion about its future.

“We had just under 60 people attend, representing district and building leaders, staff, students, parents, community and business representatives,” said Bailey. “Joanne [Moran] and I did a brief overview of the budget process, with the understanding that the Future Forum would be focusing on identifying our priorities, ultimately informing current and future programming decisions.”

He said the forum began with a question; “How do we prepare the next generation of RCS students for their future in the workplace and the world?”

In a rotating focus group format, participants looked at four overarching questions about the district’s mission, its place in the world and community, student engagement and allocation of resources.

“We were so impressed by the positivity and participation during the process,” said Bailey, “[with] many voices combining to tell a story of the larger RCS community.”