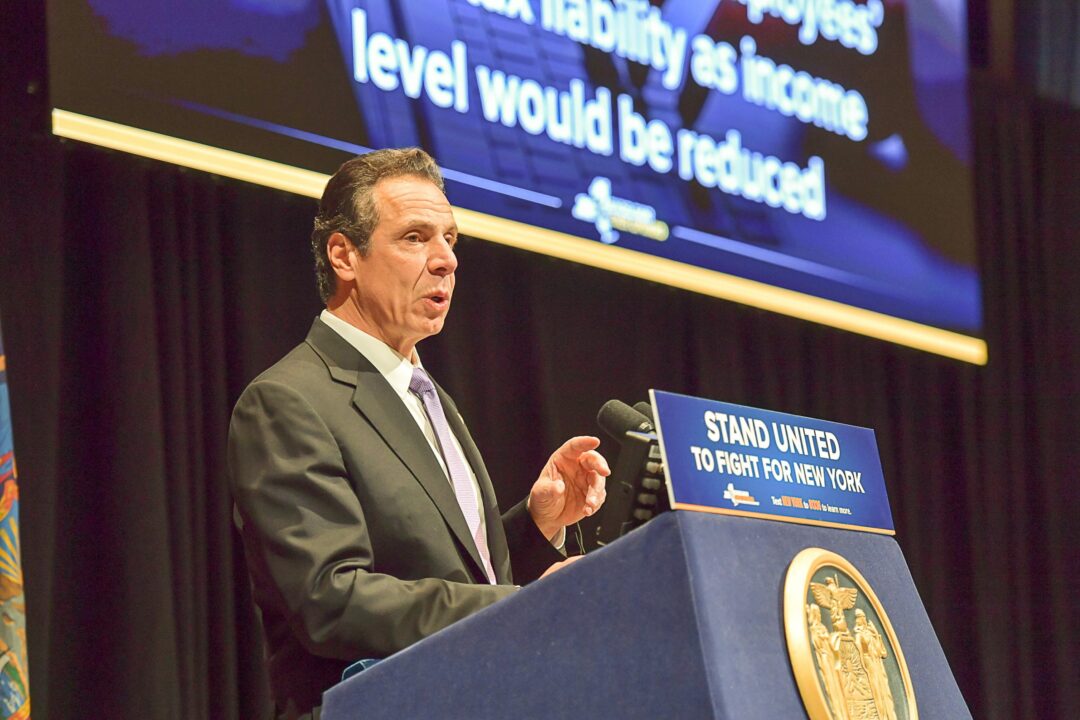

ALBANY — Gov. Andrew Cuomo unveiled his proposed fiscal year 2019 Executive State Budget on Tuesday, Jan. 16, at the New York State Museum.

“In many ways, this is going to be the most challenging budget we’ve had to do,” said the governor at the beginning of his address to state legislators. “It intertwines a number of economic and policy and legal issues, that makes the situation complicated.”

Cuomo said that, more than a budget, the 2019 financial plan is “an economic transformation plan,” and that changes being made at the federal level have necessitated changes here in New York.

To start, Cuomo said, the state is already facing a $4.4 billion deficit driven by declining revenues and expounded by a $2 billion cut in federal health care funding that could increase to $5 billion in coming years. The state is also facing a “pressing need” to renew failing infrastructure and bolster economic production, according to Budget Director Robert Mujica.

That’s the budget part.

Beyond that, however, Cuomo said the state also needs to ensure New York’s “structural economic viability in light of the federal tax plan,” which he said will raise taxes on New Yorkers by an estimated 25 percent. The loss of state and local property and income tax deductions has been characterized by Cuomo and other state leaders as double taxation and a deliberate attack by the current administration on states like California and New York, which have high taxes — and voted overwhelmingly for Hillary Clinton.

“The Federal tax plan undermines New York’s ability to compete and alters a foundational premise between the states and the Federal government that goes back more than 100 years,” said Mujica in his budget message. “The goal of the Federal tax law’s limitation on state and local tax deductibility is to take more from New York, growing the $48 billion gap between what New York state sends to Washington and what comes back in Federal spending. It threatens New York’s ability to compete for businesses and add jobs.

The state intends to address this in several ways, said Cuomo. New York will first challenge the tax plan in court as unconstitutional, stating that “it violates states’ rights and the principle of equal protection.” Second, the state plans to lead nationwide resistance against the new law, starting a repeal-and-replace effort called the “Tax Fairness for All” campaign.

More drastically, however, the Department of Taxation and Finance is exploring options to restructure state tax code in response to the federal legislation. One proposal included in the executive budget, called the “Taxpayer Protection Act,” would shift payment of income taxes from the employee to the employer.

“This shift, while dramatic, would, in many ways, thwart what the federal government was trying to do on loss of deductibility,” said Cuomo. Taxing wages rather than income, he said, would make those taxes federally deductible again. While employers would pay this tax out of their employees’ wages, Cuomo said that amount would be equal to that which would be taken by the state anyway, and would keep the federal government from being able to tax it twice. He also suggested that lower income levels, due to withholding of the wage tax, could bring some New Yorkers into a lower tax bracket and save them more on federal taxes.

Other restructuring options under consideration include the creation of additional opportunities for charitable contributions to the state and/or local governments for things like education and health care, and the possibility of adding tax deductibility through a new statewide unincorporated business tax.

“As New York launches this massive and complicated undertaking, we will engage tax experts, both houses of the legislature, employers, and other stakeholders in a thorough and collaborative process,” said Mujica, “to produce a proposal that promotes fairness for New York’s taxpayers and safeguards the competitiveness of New York’s economy.”

Other proposals intended to bolster New York’s economic competitiveness include:

•Closing of the “carried interest”

loophole by imposing a “fairness fee”

to eliminate the benefit from

preferential tax rates that exist at

the federal level (would require

regional cooperation, according to

the governor);

•Continuing to phase in middle class

tax cuts; and

•Continuing to phase in the property

tax credit.

Overall, the 2019 executive budget would increase funding for education, healthcare, economic development, transportation, the environment and all state jurisdictions. Funding for state agencies would remain flat.

The state is also looking at ways to raise at least $1 billion in revenue:

•Conversion of non-profit health care

providers, who are often paid through

Medicaid, to for-profit entities —

expected to raise $750 million from

several currently pending sales;

•A plan to recoup a 40 percent

federally-implemented (yet state-

funded) tax cut given to health

insurance companies — expected to

yield $140 million;

•A plan to tax opioid manufacturers —

$170 million;

•Closing of the carried interest

loophole — $1.1 billion;

•A large corporation tax credit deferral

— $300 million; and

•An internet market fairness act that

would tax all internet sales the same

— $318 million.

The revenue raised would be split evenly, half toward the cost of the education increase and the other half placed in a “Healthcare Shortfall Fund,” intended to guard against any reduction in health services as a result of a reduction in federal financing.

The budget increases school aid by $769 million, doubling the statutory school aid growth cap, and provides $7.5 billion for higher education. It also provides $118 million to continue the Excelsior Scholarship and extend the income cap to $110,000.

Cuomo also noted significant investments in MTA, DOT and Thruway Authority programs, and also spoke of implementing a geographic zoning system that would charge drivers for utilizing streets in the most congested areas of New York City.

“I thought the budget presentation was probably the best that the governor has given since he’s been in office,” said state Assemblyman Phil Steck after Cuomo’s address. “In government, there’s too much of a tendency to continue with the status quo and perhaps the changes at the federal level forced him to start rethinking some of the things we do and I think that’s important.”

“It appears to be good news for the district, in terms of keeping us whole,” Bethlehem Central School District’s Chief Financial Advisor Judith Kehoe told the school board during its Jan. 17 meeting. She said there had been concern that the state would implement another “GAP-style” reduction in school aid, like they did following the last national recession, but that they were relieved to hear nothing of the sort in Cuomo’s presentation. “We will be analyzing that over the next few weeks,” she said.

For a more in-depth look at the FY 2019 Executive Budget, you can access the Briefing Book at https://www.budget.ny.gov/pubs/archive/fy19/exec/fy19book/BriefingBook.pdf