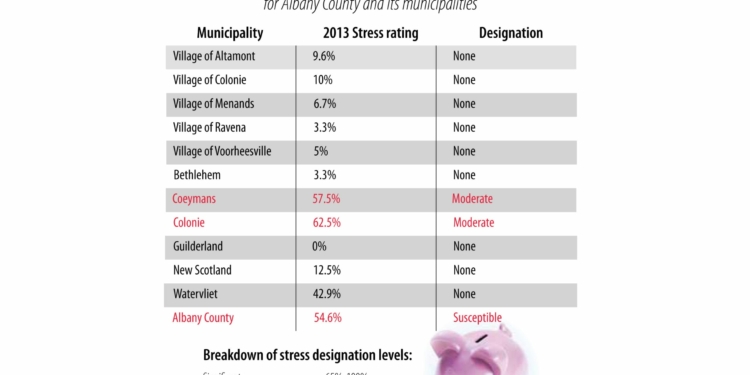

Local lawmakers are still feeling financial burdens of living within the tax cap while balancing budgets, but there are signs of improvement. Three of the 20 government entities in Albany County are designated as being fiscally stressed, ranging from moderate to susceptible, according to state Comptroller Thomas DiNapoli’s report issued Thursday, Sept. 25. The three designations of fiscal stress include significant, moderate and susceptible, with the towns of Colonie and Coeymans falling in the middle category. Albany County government received the lowest designation as susceptible. This is the second year the state Comptroller’s Office issued the report, which draws from data municipalities were already submitting. The report is based off the fiscal year ending in 2013. Any actions since then are not taken into account. DiNapoli said the “early warning system” is meant to kick off “frank discussions” in communities before a fiscal crisis develops, not after. The designation of “significant” fiscal stress ranges from a score of 100 to 65 percent. A “moderate” fiscal stress designation is from 64.9 to 55 percent. The lowest designation is “susceptible,” which includes scores from 54.9 to 45 percent. Any municipality with a score below 45 percent receives no designation. Albany County and Colonie had its fiscal stress score improve from the first report, both by exactly 3.3 percent, and dropped into a lower designation category. The county just barely dropped to “susceptible” with a score of 54.6 percent, while Colonie was lowered into “moderate” with a score of 52.5 percent. Albany County Executive Daniel P. McCoy said the fiscal management strategies and cost-saving measures implemented by his administration in the last two years have produced measurable results. This is reflected in the Fiscal Stress Monitoring Report issued today by NYS Comptroller Tom DiNapoli County Executive Dan McCoy pointed to the lowered rating as evidence his administration has made “sound fiscal decisions.” This year’s budget was the first time the county’s budget fell within the state imposed property tax cap, which McCoy plans to do again in 2015. “As we enter budget season my administration remains focused on improving our finances, reducing debt and providing value for the taxpayers,” McCoy said in a prepared statement. “The decrease in our fiscal stress score is a tangible measure of our efforts and shows we are heading in the right direction.” McCoy said he continues to focus on reducing the county’s rolling cash deficit, which was reduced from $15 million in 2012 to $10 million this year. He also pointed to recently reaching an agreement with unions representing 270 nursing home employees, which will provide annual savings. “My administration remains committed to cutting costs, implementing cost-saving efficiencies and consolidations in order to further improve county finances,” McCoy said in a prepared statement. Colonie Supervisor Paula Mahan touted the town’s designation being reduced as “great progress” and vowed to continue improving its financial stability. “We look at it as incremental changes, so every step that we improve we are happy with,” said Mahan. “We are looking at the incremental changes to keep improving rather than a category, because it is process.” Mahan said the town’s fund balance had been tapped out when she was elected in 2008, so it has been a concerted effort to restore town savings. “We had a very large deficit that we had to pay off, which was in excess of $21 million, and we paid that off,” said Mahan. “The first step was to stabilize and pay off the deficit, and we are in the building our fund balance phase.” Mahan said the fund balance has approximately $2.4 million, which the town started building back up in 2011, according to Mahan. This the seventh year of the town’s 10-year financial plan, she said, which appears to be on target. “We believe we choose the right path,” she said.

The Town of Coeymans fiscal score increased 10 percent to total 57.5 percent, which moved it from a “susceptible” to “moderate” fiscal stress designation. Coeymans fund reserves had a deficit of $200,000 last year, according to the report. The town also had an operating deficit last year of almost $750,000. Coeymans Supervisor Stephen Flach could not be reached for comment before The Spotlight went to press. Other towns across the county have maintained a score below any designation, with Guilderland receiving the best fiscal stress score at 0 percent. Guilderland Supervisor Ken Runion said the town’s fund balance has been growing, and it has not been borrowing to meet its obligations. “Even during the lagging economy, we’ve held the line on taxes and meet our obligations,” said Runion. “We’ve done a good job in just managing the finances in town, particularly in a weak economic environment.” The Town of Bethlehem scored nearly as well as Guilderland, with a score of 3.3 percent.

Bethlehem Supervisor John Clarkson said the town uses a multiyear budget projection to make financial decisions, which allows it to have a strong fiscal position. “This year’s numbers from the state Comptroller’s Office continue to show that Bethlehem is in excellent financial condition,” Clarkson said in an email to Spotlight News. The recent state Comptroller’s Office report includes all counties and towns statewide, along with 44 cities and 10 villages having fiscal years ending on Dec. 31, 2013. This is a total of 1,043 communities. There were 10 government entities receiving a “significant” designation this cycle, and eight communities designated as facing “moderate” fiscal stress. Another 17 municipalities were designated as being susceptible to fiscal stress. There were 18 municipalities receiving a higher classification of fiscal stress from 2012 scores, while 23 communities moved into a lower stress designation. The overall number of communities receiving a stress designation dropped by three, totaling 35 municipalities. Nearly 18 percent of counties were fiscally stressed, but it’s less than 2 percent for all towns.

De-stressing

Leave Comment